The pizza robotics breakthroughs coming to market in 2026 create a practical path to autonomous, delivery-optimized outlets. Early advances in precision dough handling, machine vision, integrated ovens, and cluster orchestration remove the last technical barriers to parity with staffed kitchens. For COOs, CTOs and CEOs, the questions are now tactical, not theoretical: where to pilot, how to model ROI, and how to manage regulatory and workforce transitions.

Table of contents

- Executive Summary

- Market Snapshot

- Core Trends

- Data & Evidence

- Competitive Landscape

- Industry Pain Points

- What This Means For COO, CEO, CTO

- Outlook & Scenario Analysis

- Practical Takeaways

Executive Summary

The fast-food delivery robotics market in the United States is at an inflection point in 2026. Hardware and software advances now permit repeatable, high-throughput pizza production with consistent quality and lower variable labor costs. Adoption will be driven by delivery-first demand, containerized deployment models that reduce site friction, and enterprise orchestration tools that manage multi-unit fleets. Operators who pilot now and pair robotics with delivery and loyalty systems can secure first-mover economics in dense urban and campus deployments.

Market Snapshot

The addressable opportunity sits at the intersection of the US pizza market, fast-food delivery, and ghost kitchens. Delivery and takeout remain the primary growth vectors for QSRs, and containerized robotics unlock new site formats for last-mile density. Technology attention and investment have surged, with industry coverage noting a step-change in delivery bot capabilities and deployments, including large scale urban rollouts of sidewalk delivery robots in North America. Sector demand drivers are labor cost inflation, delivery volume growth, and franchise economics that reward predictable throughput. Geographic hotspots include dense metros, large university and industrial campuses, and logistics hubs where late-night demand and labor scarcity are acute.

Core Trends

Trend 1: Precision dough automation

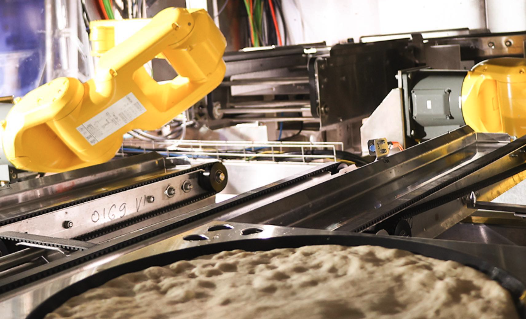

What is happening -Advanced end-effectors and force-feedback controls now manipulate dough without tearing, producing consistent thickness and edge profiles at scale.

Why it is happening – Soft robotics, torque control, and materials science have converged to provide reliable dough handling. Vendors are packaging repeatable recipes into firmware and tooling.

Who it impacts most – Production managers, food engineers, and supply chain teams at large pizza brands.

Strategic implications – Pilots should focus on recipe standardization and QA thresholds, not just speed. Achieve product parity before expanding locations.

Trend 2: Vision-led quality control

What is happening – Multi-camera arrays and real-time ML inspect topping placement, coverage and doneness, and feed corrective actions to ovens and conveyors.

Why it is happening – Higher resolution sensors and faster edge inference make closed-loop quality control affordable for containerized units.

Who it impacts most – Quality teams and franchise operations that must protect brand fidelity at scale.

Strategic implications – Require vision-based KPIs in any pilot contract, and use them to reduce refunds and waste.

Trend 3: Integrated thermal control and adaptive baking

What is happening – Multi-zone ovens with PID and neural-assisted tuning adapt bake profiles per pizza type and real-time topping moisture.

Why it is happening – Thermal sensors and feedback loops now permit deterministic crust and melt outcomes, reducing rework.

Who it impacts most – Kitchen engineers and operations planners.

Strategic implications – Negotiate performance SLAs tied to finished-product metrics, and validate with third-party bake audits.

Trend 4: Cluster orchestration and cloud-edge operations

What is happening – Multiple autonomous units are orchestrated as a single production cluster, balancing load and centralizing inventory, analytics and predictive maintenance.

Why it is happening – Edge computing and robust connectivity permit remote scheduling and fleet-level optimization.

Who it impacts most – CTOs and operations teams running multi-site rollouts.

Strategic implications – Design pilots to test cluster failover, central monitoring, and replenishment logistics. For an operational view of the full stack and deployment guidance, see Hyper-Robotics’ technical primer on fast-food robotics.

Trend 5: Workforce rebalancing and redeployment

What is happening – Automation reduces routine labor, while demand for technicians, supervisors and customer-experience roles increases.

Why it is happening – Robotics shifts labor from repetitive tasks to maintenance, quality assurance and customer-facing functions.

Who it impacts most – HR, labor relations, and training organizations.

Strategic implications – Create upskilling pathways and redeployment plans to reduce friction and preserve brand goodwill.

Trend 6: Regulatory and food-safety convergence

What is happening -Health authorities are updating inspection protocols to cover robotic processes, and operators are documenting closed-loop sanitation.

Why it is happening – Automated systems change contamination vectors and require new validation methods.

Who it impacts most – Compliance teams and legal counsel.

Strategic implications – Build audit-ready documentation and seek third-party certification early.

Data & Evidence

Industry reporting shows rising investment and deployment in delivery robotics. See this [Fast Company coverage of delivery robots] for mainstream visibility on robotics rollouts. Pizza-industry reporting highlights the need for rigorous pilots and careful economics; for that perspective, consult the [PMQ Pizza Power Report 2026]().

Hyper-Robotics frames the technology stack and operational benefits of full automation for fast-food restaurants, and provides deployment guidance for enterprise operators in its [technical primer on fast-food robotics]. For pizza-specific operational designs and 24/7 automation considerations, review Hyper-Robotics’ brief on recipe-to-robot flow and QA loops in the [autonomous pizza restaurants brief].

Competitive Landscape

Established players

Large QSR technology partners and legacy oven and POS suppliers are retrofitting automation into existing footprints.

Disruptors

Startups focused on end-to-end autonomous pizza units and specialized delivery robots are targeting greenfield formats.

New business models

Managed-service robotics, CAPEX leases of containerized kitchens, and franchise-integrated automation are emerging.

How competition is shifting

Competition moves from individual machines to platform orchestration, after-sales services and data-driven optimization. Winning vendors will offer lifecycle SLAs and cluster orchestration tools.

Industry Pain Points

- Operational friction – Site permitting, utilities, and last-mile congestion still slow rollouts.

- Cost pressures – Upfront capex and integration work can delay payback without careful pilot data.

- Regulatory uncertainty – Variable jurisdictional acceptance of automated food operations increases compliance overhead.

- Staffing and change management – Franchisee buy-in and labor displacement risks are material.

- Technology – Integration with POS, aggregators and loyalty systems requires robust APIs and security testing.

Opportunities & White Space

Underexploited growth areas

High-density last-mile nodes such as university campuses, stadiums and industrial districts.

Incumbents missing

Many operators neglect cluster-level analytics and predictive replenishment, which are core to scaling autonomous kitchens.

Platform white space

End-to-end managed services that combine containerized hardware, fleet orchestration and aggregator integrations present attractive, lower-risk options for conservative operators.

What This Means For COO, CEO, CTO

COO

Prioritize pilots that measure orders per hour, first-time accuracy and cost per order. Require performance SLAs and ops playbooks.

CEO

Build a phased rollout plan that aligns automation with market expansion objectives, and design franchise economics for managed services.

CTO

Define integration standards for POS, loyalty, aggregators and telemetry, and require third-party penetration testing and OTA governance.

Outlook & Scenario Analysis

Conditions stay the same

Steady pilot adoption in 2024–2025 leads to measurable national rollouts in targeted metros by 2026 for operators with disciplined ROI playbooks.

A major disruption happens

A breakthrough in low-cost, high-reliability robotics or a large investment round could accelerate deployments and compress payback windows. Industry visibility in mainstream outlets suggests appetite for rapid scale, and that can shorten timelines for operators that move quickly.

Regulation shifts

If regulators simplify approvals and offer clear sanitation protocols, rollout velocity increases sharply. Conversely, restrictive rulings in key markets could push automation toward private campuses and controlled environments.

Practical Takeaways

– Run a 90-day pilot with clearly defined KPIs, including bake consistency, orders/hour, uptime and cost per order.

– Build integration contracts with POS and aggregator partners before hardware deployment.

– Include workforce redeployment and upskilling in the pilot budget.

– Insist on audit-ready food-safety documentation and third-party validation.

– Design pilots to test cluster orchestration, inventory centralization, and remote maintenance workflows.

Key Takeaways

– Pilot now, scale selectively: begin in dense delivery markets with clear ROI triggers.

– Prioritize vision and bake-performance KPIs, not only throughput.

– Treat orchestration and maintenance as core capabilities, not add-ons.

– Use managed-service models to align franchise economics and lower capital barriers.

FAQ

Q: How should I select the pilot site for a robotic pizza unit?

A: Choose locations with high delivery density, reliable utilities and permissive permitting. Prioritize sites where late-night demand and labor constraints create the largest economic delta. Ensure aggregator coverage and loyalty integration in the catchment area. Build a pilot that runs for at least 60 to 90 days to capture weekly and seasonal patterns.

Q: What KPIs prove success in a pizza robotics pilot?

A: Track orders per hour, first-time accuracy, mean time between failures, uptime, and cost per order. Monitor customer satisfaction and refund rates. Use vision-derived quality metrics, such as topping coverage and bake uniformity, to tie technical performance to customer outcomes.

Q: How do robotics affect labor and franchise economics?

A: Robotics reduce routine labor but increase demand for technicians and supervisors. For franchises, managed-service or lease models lower upfront costs and create predictable OPEX. Design redeployment and training programs to retain workforce knowledge and minimize social friction.

Q: What are the main regulatory hurdles to expect?

A: Local health inspections will require documentation of automated processes, cleaning cycles and material safety. Some jurisdictions may request third-party audits. Engage inspectors early and present repeatable SOPs and sanitation logs to accelerate approvals.

Q: How secure are connected robotic kitchens?

A: Security depends on architecture, encryption, and governance. Require end-to-end encryption, OTA update controls, role-based access, and third-party penetration testing. Treat telemetry and order data as sensitive commercial assets and implement zero-trust principles.

Q: What commercial models should I evaluate?

A: Consider CAPEX purchase for operators with strong balance sheets, and managed-service or lease models to preserve capital and simplify franchise integration. Evaluate vendor SLAs for uptime, parts availability and remote diagnostics.

About Hyper-Robotics

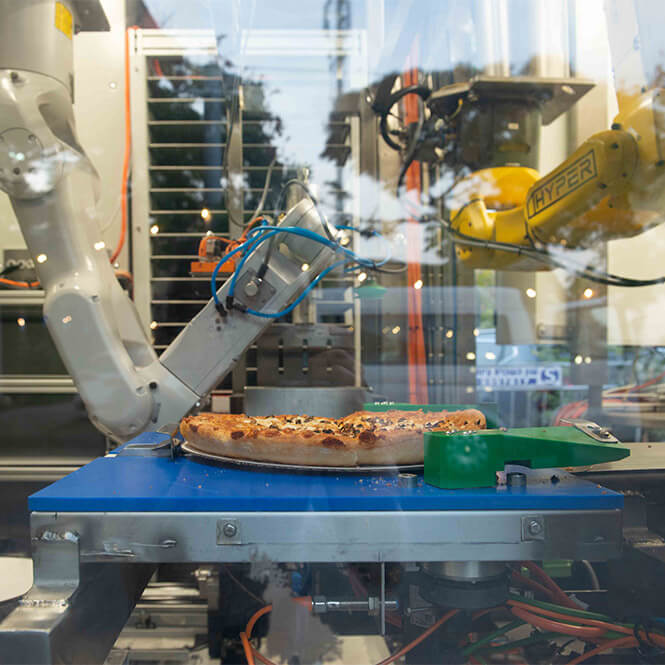

Hyper Food Robotics specializes in transforming fast-food delivery restaurants into fully automated units, revolutionizing the fast-food industry with cutting-edge technology and innovative solutions. We perfect your fast-food whatever the ingredients and tastes you require.

Hyper-Robotics addresses inefficiencies in manual operations by delivering autonomous robotic solutions that enhance speed, accuracy, and productivity. Our robots solve challenges such as labor shortages, operational inconsistencies, and the need for round-the-clock operation, providing solutions like automated food preparation, retail systems, kitchen automation and pick-up draws for deliveries. For an operational view of the stack and deployment guidance, see Hyper-Robotics’ technical primer on fast-food robotics. For pizza-specific process flows and 24/7 automation design, review our dedicated brief on autonomous pizza restaurants.